Florida Realtors economist: The new “Profile of Home Buyers and Sellers: Florida Report” finds that all buyers face challenges – but the bar is extremely high for the state’s first-timers.

ORLANDO, Fla – The surge in home prices last year has been a boon to homeowners but has also made it more difficult for first-time homebuyers to enter the housing market.

As of February 2022, the increase in the value of the typical home in Florida rose 17% to $381,481, an increase of nearly $70,000 in 12 months. That figure was slightly higher than the median household income in Florida, which was $55,660 last year before taxes, according to Census Bureau data.

Collectively, U.S. homeowners with mortgages gained more than $3.2 trillion in equity in 2021 compared with a year earlier, according to housing-data provider CoreLogic. For people who already owned a home, the increased value fueled strong down payments for trade up homes.

But for first-time home buyers, the goal just moved farther down the field, particularly as wage growth didn’t accelerate enough to offset this increase, and pandemic-era savings from lower consumer spending and government stimulus money has largely burned off the typical Floridian’s household balance sheets. A low interest rate environment certainly helped, but as we previously wrote, the rapid price appreciation in 2021 almost nearly washed those savings away.

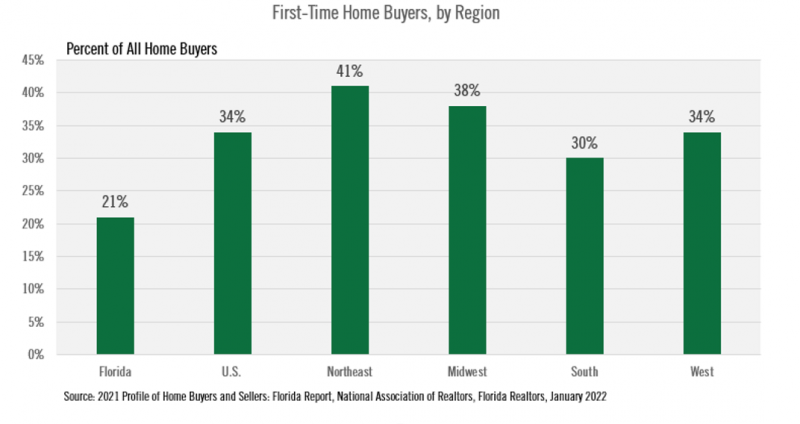

As the 2021 Profile of Home Buyers and Sellers: Florida Report prepared by the National Association of Realtors® in January 2022 indicates, a divide between first-time and repeat buyers is evident and widening. In 2021, the percentage of Florida first-time homebuyers was 21%, well below the national and regional percentages. Nationally, homeownership by first-time buyers has been in decline since the height in 2010, when nationally this group comprised 50% of all home purchases.

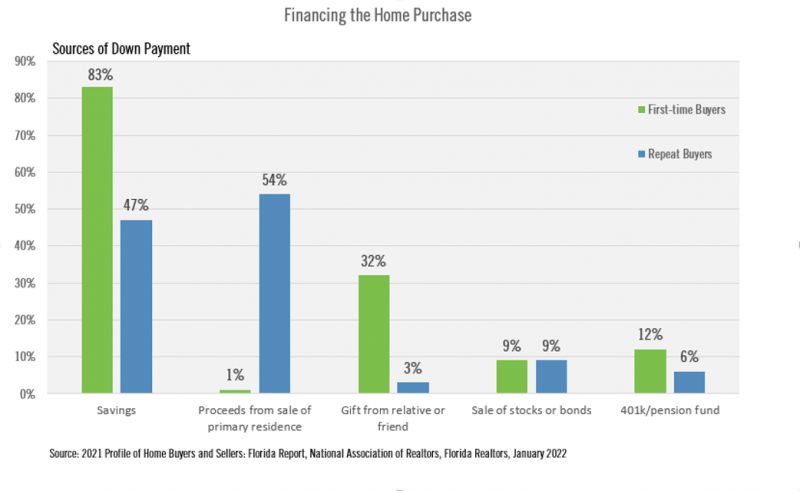

When considering a home purchase, the largest obstacle is typically the down payment, which tends to range between 3% and 20%. For a median-priced home in Florida in February 2022, that could be between $11,000-$76,000. Repeat buyers who cash out of existing homes and put the proceeds from the sale toward their down payment find this is a much easier feat. In fact, 54% of repeat buyers in Florida did this in 2021 and relied less on their savings to fund their purchase.

First-time buyers, however, did not have this source of capital to pull from, and 83% of people in this category relied on their savings to finance their first home purchase compared to 47% of repeat buyers. It’s unknown how much of their savings remain intact after funding their down payment, but this tends to create some burden initially for first-time homebuyers who then face additional expenses without much liquid savings available.

Repeat buyers using cash-out equity typically make a larger down payment without compromising their savings, making a median percent of down payment around 17% in 2021; first-time homebuyers put down around 7%. When considering the level of competition in the marketplace, offers with larger down payments tend to be more attractive to home sellers, particularly in a multiple-offer environment.

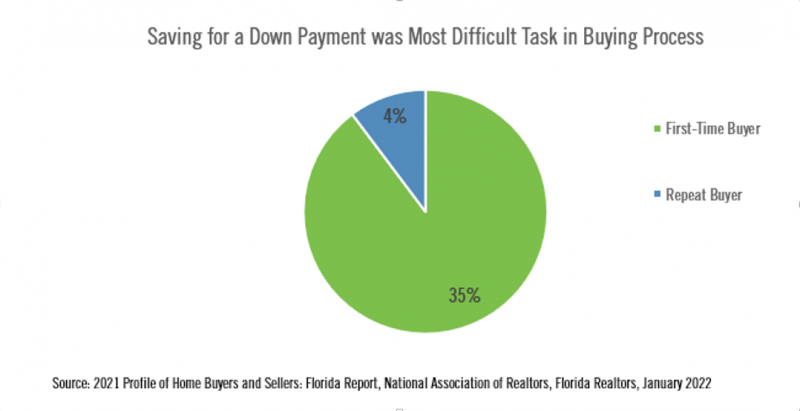

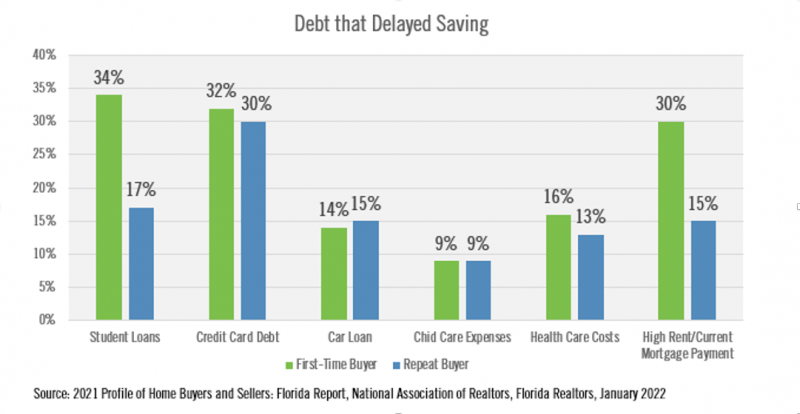

Given the difficulty of funding a down payment and the competition with repeat buyers with stronger offers, 35% of first-time buyers indicated that saving for a down payment was the most difficult task in the buying process compared to 4% of repeat buyers. There are several types of debt that hindered their ability to save that were harder for this group than for repeat buyers, namely student loans and, unsurprisingly, the high cost of rent. Both obstacles were double in terms of their impact to this group of buyers.

Considering 72% of first-time homebuyers in Florida rented an apartment or house prior to their first purchase compared to 15% of repeat buyers, continued increases in rent will keep pressing on their ability to save. Coupled with an expected return to student loan payments coming due within a few months, headwinds for first-time buyers looking to save for a down payment and home purchase are expected to continue.

Floridians on the move

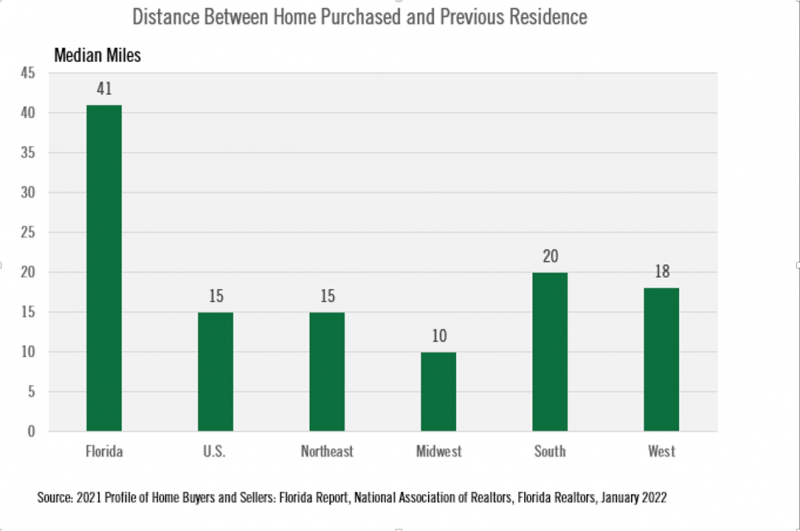

There has been a lot of talk about out-of-state migration since 2020, but there is a lot of intrastate migration taking place as well. It goes to reason that when supply and demand get to the point where housing prices increase, one of the sources of relief can be to look farther away from typical high-cost areas for homes that are less expensive. In Florida, that bears out. People are increasing the distance between the home they purchased in 2021 and their previous residence.

Anecdotally, Realtor members say some of these moves are fueled by a quest for affordable homes, particularly in areas where out-of-state buyers are pushing median home prices well above their historic norms. Parts of south and central Florida come to mind with buyers relocating from the Northeast and West.

Others are moving because they’re no longer tied to traditional employment hubs, thanks to increased remote and hybrid work options. As such, the median seller tenure has decreased slightly, pointing to this increased mobility.

There are a lot of insights to be gained from this recent survey. Treat yourself to a deeper dive by looking at the highlights featured here, or the entire report can be viewed here. Understanding more about Florida buyers and sellers will help you strategize on how best to serve your clients on either side of the deal.

Jennifer Warner is an economist and Florida Realtors Director of Economic Development.

© 2022 Florida Realtors®

Go to Source

Author: kerrys