By Kerry Smith That happened last week. Fla. agents continue to receive demand letters over photo copyright issues. But a safe-harbor provision provides some immunity for IDX claims. ORLANDO, Fla. – Under U.S. copyright law, someone owns almost all the photos, writings, drawings, music, printed material and videos on the internet – and people who don’t hold the copyright to those things cannot use them without permission. In real estate, most brokers and agents already know this. And while a handful may break the rule now and again on the theory that they won’t get caught – they will, eventually

Read More

Yearly Archives 2020

Citizens Ins.: Steep Rate Hikes Would Discourage New Customers

By Ron Hurtibise The Fla.-owned “insurer of last resort” met Wed., with the board saying it intended to aggressively get smaller. Chairman Carlos Beruff called current rates artificially low; CEO Barry Gilway said new policies are cheaper than 91% of policies in the private market. TALLAHASSEE, Fla. – Alarmed by rapid increases in the company’s policy count, members of Citizens’ Board of Governors on Wednesday declared their intention to move aggressively to get smaller. That means finding ways to charge more money so fewer consumers will be eligible to buy insurance from Citizens. Currently, customers can sign on with Citizens

Read More

Mortgage Rates Hit 15th Record Low in 2020

By Kerry Smith In 2020, the all-time-low mortgage rate record has been broken on 15 occasions or 30% of the time. This week, the 30-year, fixed-rate loan averaged 2.67%. MCLEAN, Va. – The phrase “mortgage rates fell to record lows this week” has been overused in 2020, but it remains good news for homebuyer who can qualify for a larger mortgage loan every time it happens. Freddie Mac has kept average-mortgage-rate records since 1971, and in 2020, the average rates dropped to a record low – and they did it 15 times, or about 30% of the weeks of the

Read More

Builder Confidence Drops After 3 Record-Breaking Months

By Kerry Smith At 86, the builders’ index remains in solid territory since scores over 50 show optimism. But supply costs, limited land and lack of skilled workers has taken a toll. WASHINGTON – Builders’ confidence levels fell a bit in December, ending a string of three successive record-high months. Confidence in the market for newly built single-family homes fell four points to 86 this month, according to the latest NAHB/Wells Fargo Housing Market Index (HMI). Despite the decline, however, it’s still the second-highest reading in the history of the series after peaking at 90 last month. “Housing demand is

Read More

Worries Could Put Citizens Insurance Rate Filing on Hold

By Jim Saunders, Carlos Beruff The Fla.-owned insurer’s proposed rates weren’t discussed yesterday and will now be considered Jan. 26 after critics said proposed increases weren’t high enough. Citizens is no longer the insurer of last resort, it’s “the insurer of first resort and growing rapidly,” says Chairman Carlos Beruff. TALLAHASSEE, Fla. – State-backed Citizens Property Insurance Corp. appears likely to delay a proposed rate filing announced earlier this week, as leaders worry about a rapidly increasing number of policies and trouble in the private insurance market. The Citizens Board of Governors was expected to take up a proposal on

Read More

Realtor.com Acquires Avail, Expands Move into Rental Market

By Kerry Smith Avail is designed for do-it-yourself landlords and tenants. It includes educational content, “contactless rental opportunities” and a system for online rent payments. SANTA CLARA, Calif. – Move Inc., the operator of realtor.com, announced that it acquired Chicago-based Avail, a platform designed for do-it-yourself landlords and tenants with online tools, educational content and support. Move Inc. is a subsidiary of News Corp. Residential rentals are a large U.S. market. According to an analysis of American Community Survey data from the U.S. Census Bureau, people spend more than $500 billion per year on rent, and do-it-yourself (DIY) landlords (those

Read More

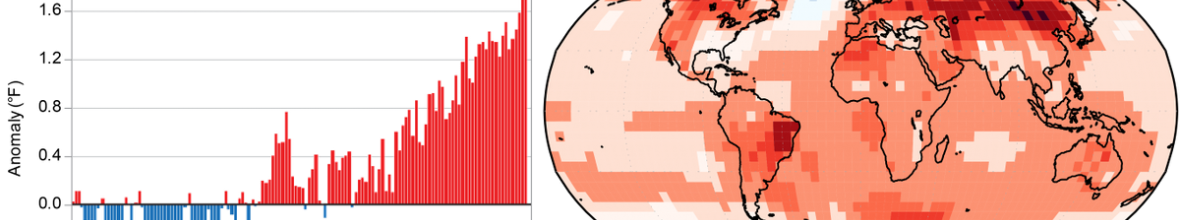

Climate Change Impacting Home Value in Higher Risk Areas

Study: Homes in high-risk flood areas appreciated about 5% less than homes in low-risk areas over the past five years. For homes in fire-risk areas, it was 3% less. CHICAGO – Demand may fall for homes in areas at high risk of natural disasters, such as flooding and wildfires, which could cause price growth to slow. A new realtor.com analysis shows that properties in such areas will likely see 5% less price growth in 2021 than homes in similar areas at low risk of natural disaster. This trend is already rising. Home sales price growth in high-risk flood areas was

Read More

Mortgage Rule Changes Should Help Homebuyers

Lenders like to issue qualified mortgages (QM) because they know upfront that they can sell those loans to Fannie Mae or Freddie Mac, and then fund more home purchases. A change to QM standards should, in many cases, make it easier for buyers to qualify for a loan. WASHINGTON – The Consumer Financial Protection Bureau (CFPB) issued final rules Thursday that revise its definition of “qualified mortgages,” or QM, which could impact a significant number of mortgage originations across the country. The federal government requires lenders to verify that a borrower has the financial means to repay a mortgage before

Read More

Fla.-Run Citizens Insurance Proposes 3.7% Rate Hike

By Kerry Smith Every county has at least one home covered by Fla.-owned Citizens Property Ins. An average 3.7% increase is as high as 7.6% in one – but a 0.6% drop in Miami-Dade. TALLAHASSEE, Fla. – Citizens Property Insurance Corp.’s Board of Governors on Wednesday will be asked to approve a 2021 rate package recommendation that reflects the impacts of reinsurance costs, litigation and nonweather related water losses. At the meeting, board members will consider a statewide average increase of 3.7% for personal lines’ policyholders – homeowners, condominium unit owners, mobile homeowners, dwelling and renters. If approved by the

Read More

Provision Would Force all Shell Companies to Reveal Ownership

By Kerry Smith A move to fight money laundering promoted by Sen. Rubio would require shell companies in real estate transactions nationwide to identify their actual owners. WASHINGTON, D.C. – U.S. Senator Marco Rubio (R-FL) says he secured a provision in the National Defense Authorization Act (NDAA) for Fiscal Year 2021 (H.R. 6395) conference report that will help stop criminals, including sophisticated criminal organizations, from using anonymous shell corporations to engage in illicit activities like money laundering, sex trafficking, fraud, and terrorist financing. The initiative has already passed the Senate. “In my home State of Florida, including in Miami, our

Read More