By Matt Ott Sales came in at 923K – much higher than the 842K economists expected even after revising Dec. numbers. That increase is also 19.3% higher than sales in Jan. 2020. SILVER SPRING, Md. (AP) – Demand for new homes in the U.S. surged 4.3% in January with the housing market still one of the strongest segments of the economy. Last month’s increase pushed sales of new homes to an adjusted annual rate of 923,000, the Commerce Department reported Wednesday. That’s much stronger than the 855,000 that economists were expecting. December’s new home sales figure was revised higher as

Read More

Monthly Archives February 2021

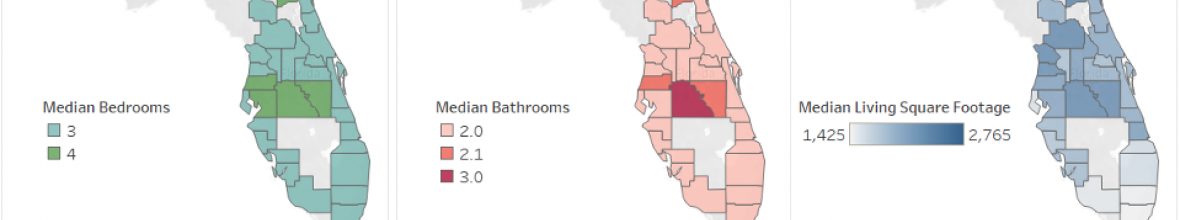

Dare to Compare: What Does $300,000 Buy in Fla.?

By Erica Plemmons Florida Realtors economist: A lesson learned during the pandemic: Remote workers who aren’t tied to a specific location can search for housing values located anywhere. And with flexibility, it’s still possible to find a 3-bed, 2-bath Fla. home for $300,000 or less. ORLANDO, Fla. – The vaccine rollout has started, but remote work, at least in some form, is here to stay. That means employees no longer need to reside within commuting distance of their office. With expanded options, workers are empowered to change their primary residence or purchase a second home for a change of scenery

Read More

Anti-LGBTQ Housing Bias Illegal Based on Court Decisions

By John Lord Jr. A Supreme Court ruling that sex discrimination includes LGBTQ now applies to housing – and the Fla. Commission on Human Relations says it will investigate complaints. ORLANDO, Fla. – When the U.S. Supreme Court ruled last year (in the “Bostock” case) that Title VII of the Civil Rights Act of 1964 protects employees from discrimination based on sexual orientation and transgender status, many predicted the ruling would extend to other anti-discrimination laws in areas such as housing, health care, education and public accommodations. Those predictions are becoming reality. Your business should already have in place anti-discrimination policies,

Read More

PPP Loans: Do You Qualify? Should You Apply?

By Kerry Smith While a lifeline to struggling businesses, PPP loans also created confusion – but new easy-to-understand guidelines cover applying, second-draw loans and PPP forgiveness. WASHINGTON – Paycheck Protection Program (PPP) loans created under federal programs to help businesses weather the coronavirus pandemic offer a lifeline to businesses struggling to make it through the downturn and thrive once it ends. However, the loans have created some confusion, and many businesses who could benefit have been slow to apply. To help simplify the process, the National Association of Realtors® (NAR) created a series of one-page information guides that make it

Read More

Feb. Consumer Confidence Continues Optimistic Trend

By Kerry Smith If consumer spending drives the economy, a rebound in confidence reflected in the Feb. and Jan. reports suggests a slow emergence from the darkest days of the pandemic. Consumers’ attitudes about their current finances rose for the first time in three months. BOSTON – The Conference Board Consumer Confidence Index reflects a growing optimism among Americans. The index improved again in February after increasing in January. The Index now stands at 91.3, up from 88.9 in January. The Present Situation Index – based on consumers’ assessment of current business and labor market conditions – climbed from 85.5

Read More

U.S. Home Prices Up 10.1% in Dec. – Highest Since 2014

By Paul Wiseman Fueled by low interest rates and high buyer demand, home prices surged 10.1% higher year-to-year in Dec., according to the Case-Shiller 20-city home price index. WASHINGTON (AP) – U.S. home prices surged at the fastest pace in nearly seven years in December, fueled by low mortgage rates and Americans moving from crowded urban areas to houses in the suburbs. The S&P CoreLogic Case-Shiller 20-city home price index, released Tuesday, climbed 10.1% in December from a year earlier. The year-end jump was the biggest since April 2014 and follows a strong 9.2% year-over-year gain in November. Home prices

Read More

Washed-Up ‘Old’ Millennials Still Can’t Afford a Home

By Jessica Lipscomb Report: The oldest millennials are turning 40 soon, but 58% couldn’t afford a home before they turned 30, and two out of three have no money toward a down payment. MIAMI – The next time you hear someone griping about “millennials” as a catchall for “young people,” feel free to remind them that the oldest millennials are now nearing 40. They’re old enough to have children and back problems. Unlike their cool Gen Z siblings, they still – gasp! – wear skinny jeans. The youngest millennials are currently about 24 years old – old enough to possibly

Read More

Flood Insurance Data Report Finds Many Policies May Be Underpriced

By Alex Harris The firm responsible for flood-risk estimates on realtor.com concluded that many current flood policies don’t charge enough to cover actual risk. Their data could become even more important in 7 months when FEMA starts quoting individualized prices for flood policies. MIAMI – If you live in Florida, you should probably be paying more for flood insurance. And you likely will be soon. That first finding is the conclusion of a new analysis by First Street Foundation, a nonprofit research group focused on climate impacts on property value, which found that the majority of Floridians face a higher

Read More

Tech Companies Hope to Solve 3 Buyer Problems

By Melissa Dittmann Tracey Three new types of software can help buyers estimate repair costs and flood insurance costs before purchasing, and buy a home while still saving for a down payment. WASHINGTON – A range of new real estate tech may help solve some common obstacles that may be standing in your clients’ way for closing. Panelists at a recent National Association of Realtors® (NAR) forum discussed some new technology solutions that could help buyers in multiple ways, including overcoming financial hurdles, getting easier access to flood insurance information, and gathering remodeling estimates to help make more informed buying

Read More

Single-Family Home Investors? That Market Is Getting Crowded

By Bloomberg Institutional investors opened up the single-family rental market during the Great Recession, but pension funds, builders and apartment managers are hopping on board. NEW YORK – Wall Street’s zest for a corner of suburban real estate long left to small landlords is reaching new heights, attracting institutional investors, homebuilders and apartment managers during a pandemic that has ignited demand for larger homes. The pension manager for the Canadian Mounties is the latest investor in single-family rentals (SFR), joining JPMorgan Chase & Co.’s asset-management arm and Nuveen Real Estate in a bet that there are lots of Americans who

Read More