By Matt Ott The Fed announced it would tighten monetary policy more quickly, which pushed the 30-year, fixed-rate mortgage higher compared to last week’s 3.22%. SILVER SPRING, Md. (AP) – Average long-term U.S. mortgage rates jumped again this past week, reaching their highest level since March 2020, just as the coronavirus pandemic was breaking in the U.S. Mortgage buyer Freddie Mac reported Thursday that the average rate on the benchmark 30-year home loan rose to 3.45% this week from 3.22% last week. It was at 3.5% in late March of 2020 when the pandemic was just starting. A year ago,

Read More

Yearly Archives 2022

Disaster Relief Fund Awards $200K in 2021

When Realtors, employees or association staff need help following a natural disaster, Florida Realtors Disaster Relief Fund steps in to help. ORLANDO, Fla. – Florida Realtors® formed Florida Association of Realtors® Disaster Relief Fund (DRF) as a trust dedicated to helping Realtors, their employees, local associations and staff if a natural disaster impacts their area and their homes. In 2021, the DRF awarded $200,000 to aid organizations working directly with U.S. Realtors facing hard times thanks to a natural disaster. “The Disaster Relief Fund was first created back in 1992, so it’s been around a long time,” says 2022 DRF

Read More

2021 Foreclosure Activity Hits All-Time Low

By Kerry Smith That tsunami of foreclosures expected when forbearance ended? Barely a splash. ATTOM predicts an uptick that won’t reach “normal levels” until year’s end. IRVINE, Calif. – In 2021, foreclosure filings – default notices, scheduled auctions and bank repossessions – hit an all-time low, according to ATTOM’s Year-End 2021 U.S. Foreclosure Market Report. The percent of U.S. properties in foreclosure dropped 29% over 2020 and 95% from a peak of nearly 2.9 million in 2010. ATTOM says it’s the smallest number of foreclosures since it began tracking in 2005. Overall, 151,153 U.S. properties had foreclosure filings in 2021

Read More

Americans Moving to Sun Belt States

Both U-Haul and United Van Lines listed Fla. as a top destination state. NAR’s chief economist credits affordability, job creation and lower taxes for the moves. WASHINGTON – Job-rich, low-tax states such as those in the Sun Belt are attracting many Americans as housing prices rise, different recent reports show. Online real estate marketplace Zillow and moving rental company U-Haul both cited Florida and Texas as hot relocation destinations in separate reports, while United Van Lines listed Florida and South Carolina among the top states for inbound migration. “Sun Belt states are more affordable and generally have a lower tax

Read More

2022 RE Trends: What’s Ahead for Fla. Real Estate?

By Marla Martin If only there was a way to predict the future so you could prepare? There is. On Jan. 20, virtually and in-person, Fla. economists will unveil their 2022 predictions. ORLANDO, Fla. – Real estate drives Florida’s economy, and as the COVID-19 pandemic continues its second year, knowing what lies ahead in 2022 is key for policymakers, residents and Realtors. As part of this year’s Florida Real Estate Trends summit, Florida Realtors® Chief Economist Dr. Brad O’Connor will share his outlook for Florida’s economy and housing market in 2022. A highlight of Florida Realtors 2022 Mid-Winter Business Meetings, the

Read More

Fannie Announces Free Courses for New Homebuyers

By Kerry Smith The online service aligns with national course standards – the level first-time buyers need to qualify for some mortgage products, like low-down payment loans. WASHINGTON – Fannie Mae announced the launch of HomeView, a new online homeownership education course to help consumers navigate the mortgage and homebuying process. The seven-part education series is free, and Fannie Mae says it aligns with National Industry Standards required for first-time homebuyers to qualify for certain mortgage products, including low-down-payment loans. According to Fannie Mae’s media release, it provides “a clearer path to homeownership for more qualified homebuyers, including low- and

Read More

Citizens Ends 2021 with 759K Policies

By Jim Saunders The Fla.-owned “insurer of last resort” added 217K policies in a year. Lawmakers seek solutions, and a number of changes are being considered. TALLAHASSEE, Fla. – The state-backed Citizens Property Insurance Corp. added thousands more policies (18,000) in December, and the Florida Legislature is now considering new legislative proposals that would steer more homeowners into the private insurance market. As of Dec. 31, Citizens had 759,305 policies, an increase of nearly 217,000 policies from a year earlier as private insurers shed customers and sought hefty rate increases amid financial troubles in the industry, according to newly posted

Read More

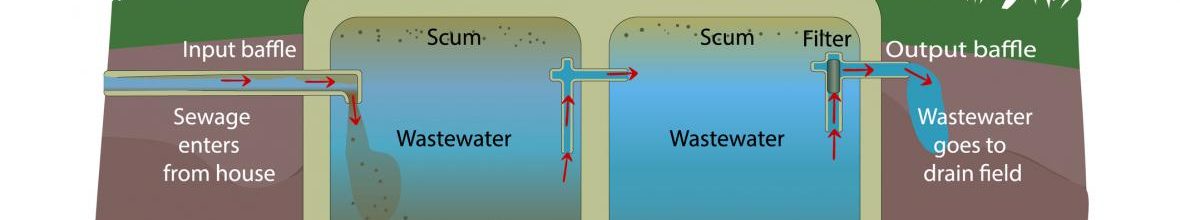

Bill Embraces Algae Task Force Recommendations

By Kerry Smith A Fla. legislative committee unanimously passed some Blue-Green Algae Task Force recommendations, including a septic tank inspection every five years. TALLAHASSEE, Fla. – The Florida Senate Environment and Natural Resources Committee unanimously advanced a bill Monday recommended by the state’s Blue-Green Algae Task Force. Among other things, SB 832 (Sen. Linda Stewart, D-Orlando) would require septic tank inspections every five years. The bill has two more committee stops before it would be considered by the full Senate. In 2019, Gov. Ron DeSantis directed the Department of Environmental Protection (DEP) to create a Blue-Green Algae Task Force to

Read More

Did Fed Wait Too Long to Fight Inflation?

By Christopher Rugaber While many people back the Fed’s long low-interest policies, some experts think it may be forced to increase interest rates more than three times this year. WASHINGTON (AP) – With inflation surging, unemployment falling and wages rising, some economists are warning that the Federal Reserve may have waited too long to reverse its ultra-low-rate policies – a delay that could put the economy at heightened risk. On Wednesday, the government is expected to report that consumer prices jumped 7.1% over the past 12 months, which would be the steepest such increase in decades. Fed Chair Jerome Powell

Read More

Home Prices Settling in West, Rising in Fla.

FAU and FIU: The hot housing market appears to be cooling in the West, but for some reason eastern U.S. cities continue to see rising price levels. BOCA RATON, Fla. – According to researchers at Florida Atlantic University (FAU) and Florida International University (FIU), the housing market appears to be cooling in the American West while the eastern United States still sees price hikes. The November analysis indicates that homes are overvalued in 98 of the top 100 housing markets, with just Honolulu, Hawaii and Baltimore, Maryland, offering bargains. “These latest results suggest that the long-anticipated housing downturn is already

Read More