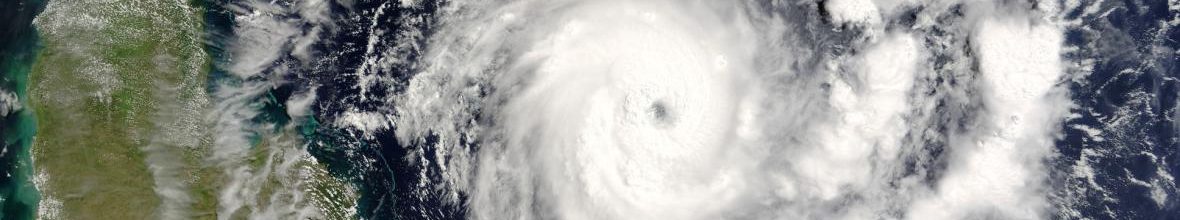

By Latisha Nixon-Jones While FEMA may still be given additional funding, these strategies can help Hurricane Idalia survivors get federal aid faster. JACKSONVILLE, Fla. – As questions loom over the Federal Emergency Management Agency’s (FEMA) ability to fund disaster recovery efforts, people who lost homes to recent wildfires and storms are trying to make their way through the difficult process of securing financial aid. Residents in communities hit by Hurricane Idalia, the Maui fires or other recent disasters have a long, tough journey ahead. How well the initial disaster response meets their needs has far-reaching consequences for community resilience, especially

Read More

Monthly Archives August 2023

Mortgage Rates Retreat, Drop to 7.18%

By Alex Veiga After hitting a 20-year high last week of 7.23%, the average rate on a 30-year, fixed-rate mortgage moved lower again. A year ago, the FRM averaged 5.66%. LOS ANGELES – The average long-term U.S. mortgage rate slipped after climbing for five consecutive weeks to a more than 20-year high, a modest relief for would-be homebuyers challenged by rising home prices and a thin inventory of homes on the market. Mortgage buyer Freddie Mac said Thursday that the average rate on the benchmark 30-year home loan fell to 7.18% from 7.23% last week. A year ago, the rate

Read More

Biden Approves Hurricane Idalia Disaster Declaration

By Jim Turner The order includes Citrus, Dixie, Hamilton, Lafayette, Levy, Suwannee and Taylor counties and clears the way for federal funds to aid in their recovery. TALLAHASSEE, Fla. – President Joe Biden on Thursday approved a federal disaster declaration to help state and local recovery efforts after Category 3 Hurricane Idalia slammed into North Florida’s Big Bend region and caused widespread damage. The disaster declaration will make federal money available for people affected by the storm in Citrus, Dixie, Hamilton, Lafayette, Levy, Suwannee and Taylor counties. Idalia made landfall Wednesday morning in the Keaton Beach area of Taylor County

Read More

Florida Realtors Disaster Relief Fund Q&A

By Patrick A. Cairns Florida Realtors’ members, brokers and local association staff impacted by Hurricane Idalia can apply for financial help through the association’s Disaster Relief Fund. ORLANDO, Fla. – The Florida Realtors® Disaster Relief Fund (DRF) assists Realtors®, their employees and staff of local associations who have experienced damage to their primary residences or offices caused by natural disasters, including the recent landfall of Hurricane Idalia. DRF Frequently Asked Questions 1. Question: Who is eligible for funds from Florida Realtors Disaster Relief Fund?Answer: Eligible applicants are active members of Florida Realtors, staff of Florida Realtors and staff of Florida

Read More

DeSantis Warns Insurers About Hurricane Idalia Claims

By Lawrence Mower Accusations suggest some Fla. insurers shortchanged policyholders last year, but a new 2023 law tightens how insurers handle claims and increases penalties if they fail to do so. MIAMI – After some Florida insurance companies were accused of shortchanging customers’ claims after Hurricane Ian last year, Gov. Ron DeSantis and state regulators are warning insurance companies to make whole homeowners who experience damage from Hurricane Idalia. “We’re gonna be watching,” DeSantis said Monday night. “We want to make people whole who pay for this service. And I think that they deserve to have their claims honored.” On

Read More

Investors Pull Back, 45% Fewer Homes Year-to-Year

By Kerry Smith Investors face the same problems as first-time buyers: low inventory and high mortgage rates. Dollar volume was down 42%, as investing in Jacksonville dropped 65%. SEATTLE – Investor home purchases fell 45% year-to-year in the second quarter, outpacing the 31% drop in overall home sales, according to a Redfin report. It’s the second-biggest decline since 2008 after a 48% drop in 2023’s first quarter. The report includes 30 of the largest U.S. metros. Investors are now buying fewer homes than they did before the pandemic – roughly 50,000 homes in the second quarter, the fewest of any

Read More

Reps. Concerned Over FinCEN ‘Beneficial Ownership’

By Kerry Smith On Jan. 1, 2024, millions of businesses must tell the Financial Crimes Network (FinCEN) their actual owners’ names, but the U.S. House has voiced some concerns. WASHINGTON – The Financial Crimes Enforcement Network (FinCEN) currently requires “beneficial owners” to be named before buying real estate in some U.S. cities, including Miami. Starting on Jan. 1, 2024, FinCEN plans to require a similar type of ownership disclosure for about 32.6 million U.S. businesses. FinCEN is following the U.S. Corporate Transparency Act (CTA) after facing mounting pressure from Congress to provide clarity on the beneficial ownership information (BOI) filing

Read More

Law Supersedes Seller Confidentiality in Code of Ethics

By Diane Disbrow A Realtor turned down a listing because a home had a latent defect and the seller’s preferred remedy was “Don’t tell anyone.” Now someone else listed the home. Does the first Realtor honor the “do not tell” or call the listing broker with his insider info? CHICAGO – Question: A few months ago, I had a transaction fall through because the home inspection revealed a cracked heat exchanger. The seller not only refused to fix it, but also told me to not disclose it to any buyers or cooperating brokers. I told the seller “no way” and

Read More

Dealings With Another Broker’s Client

By Shannon Allen I helped a buyer who had an exclusive relationship with another Realtor. I wrote an offer for one of my listings but only after the buyer asked me to do so. I asked the right questions before proceeding but faced a violation charge. What did I do wrong? ORLANDO, Fla. – Dear Shannon: I recently faced a baffling situation as a listing broker. I helped a potential buyer who had an exclusive relationship with another Realtor by writing an offer for one of my listings. I know that sounds bad, but the buyer asked me to write

Read More

Case-Shiller: No June Change in Yearly Home Prices

By Kerry Smith In June 2023, home prices were the same year-to-year – no increase or decrease – but they rose almost 1% in a month-to-month comparison. NEW YORK – S&P Dow Jones Indices (S&P DJI) data released for June 2023 show all 20 major metro markets reported month-over-month price increases for the fourth straight month, and prices were virtually unchanged year-to-year. “U.S. home prices continued to increase in June 2023,” says Craig J. Lazzara, managing director at S&P DJI. “Our National Composite rose by 0.9% in June, and it now stands only 0.02% below its all-time peak from exactly

Read More