Fannie Mae’s index dropped 1.2 points in Sept. More consumers (66%) thought it was a bad time to buy a home while only 28% believed it was a good time to buy. WASHINGTON – The Fannie Mae Home Purchase Sentiment Index® (HPSI) dropped 1.2 points to 74.5 in September, as survey respondents continued to report divergent opinions of homebuying and home-selling conditions. Overall, three of the index’s six components decreased month over month. Most notably, an even greater share of consumers reported that it’s a bad time to buy a home – with that number now sitting at 66% last

Read More

Monthly Archives October 2021

RE Q&A: Is Now a Good Time to Start Being a Landlord?

By Gary M. Singer To be successful, treat it like a business. Keep a cushion of several months’ expenses to carry the property’s costs in case of any issues like a non-paying tenant. FORT LAUDERDALE, Fla. – Question: We are getting older and ready to move to a smaller home. Our plan has always been to rent our existing house to make extra money toward our retirement. After the eviction moratorium, we are nervous. Is it a good time to be a landlord? — Jerri Answer: Not collecting rent is a scary prospect that every landlord needs to be prepared for. Whether it

Read More

Mortgage Rates Decrease Slightly

The average 30-year fixed-rate mortgage decreased slightly this week, easing to 2.99%; it was 3.01% last week. The 15-year FRM averaged 2.23% this week. MCLEAN, Va. – The average 30-year fixed-rate mortgage (FRM) decreased slightly this week, easing to 2.99%; however, many analysts predict that mortgage rates will continue to rise modestly over the next year. “Mortgage rates continue to hover at around 3% again this week due to rising economic and financial market uncertainties,” said Sam Khater, Freddie Mac’s chief economist. “Unfortunately, with the expectation that both mortgage rates and home prices will continue to rise, competition remains high

Read More

In Memoriam: 1971 Florida Realtors Pres. John R. Wood, 1929-2021

A real estate leader and role model who knew how to “light up a room,” the former Florida Realtors president and NAR president died Aug. 4, shy of his 92nd birthday. NAPLES, Fla. – John R. Wood knew how to “light up a room.” He used humor (corny and clean jokes) and smarts (a law degree and a down-home Arkansan sense of post-Depression resourcefulness) to build a business and lifelong relationships. It was this enviable combination plus a genuine desire to help people succeed that drew people to him. Wood founded John R. Wood Properties in 1958, the oldest active real

Read More

Investors Bet Flexible Leases Are a Lasting Trend

Remote work sparked demand for short-term housing with flexible terms. Some estimate the number of workers who remain fully remote will eventually top out at about 20%. NEW YORK – Investors believe one pandemic-related trend will offer up long-term results: short-term apartment leases. They’re rushing to invest in such buildings that can offer flexible short-term apartment rentals, even as more workers return to the office. Over the past year, companies like Blueground, June Homes, and Landing have added thousands of units to their platforms, The Wall Street Journal reports. They’re raising millions in recent funding rounds as short-term rentals win more attention

Read More

Homeowners Seek Refinancing; Mortgage Rates Over 3%

Mortgage rates remain historically low. However, industry observers say borrowers should not misinterpret the surge last week as being the last one in 2021. WASHINGTON, D.C. – A closely observed survey indicates that mortgage rates on housing loans, largely sought after in the U.S., spiked during the past week. Householders who opted for refinancing before last week, when mortgage rates were below 3% for several months, currently have a reason to rejoice on account of their prudence and the thousands of dollars they saved. The increase in mortgage rates last week should be an alarm bell for those who deferred refinancing

Read More

Condo Prices Are on the Rise in Florida

More buyers are turning their attention to condos and townhomes these days. Realtor.com’s top 10 list for growth in condo and townhouse prices includes six Fla. cities. SANTA CLARA, Fla. – Priced out of the single-family market, more buyers are now turning their attention toward often a more affordable alternative – condominiums and townhouses. Over the past year, sales have rapidly been on the rise, whether for a permanent residence or even as a second home. Twice as many condos sold in May than a year earlier, according to realtor.com® data. However, that is being measured against a 46% drop

Read More

4 Ideas About Millennial Homeowners That Never Came True

Think millennials don’t care about homeownership or just want to live in the city? Those are myths. The majority of millennials buy homes in the suburbs for instance. CHICAGO – Millennials have been a closely watched group in real estate for years, and forecasters have long made predictions about their entrance into homeownership. The beliefs about this massive segment of potential buyers have been significant – they favor renting over buying, they just want to live in the city, and they must have their parents’ help to buy. Jessica Lautz, vice president of demographics and behavioral insights at the National

Read More

Mortgage Payments Are Getting More and More Unaffordable

Fed Reserve of Atlanta: The median U.S. household currently would need 32.1% of its income to cover the mortgage on a median-priced home, the highest since 2008. ATLANTA – U.S. incomes are trailing home prices, reducing affordability for many Americans. The Federal Reserve Bank of Atlanta says the median American household would need 32.1% of its income to cover mortgage payments on a median-priced home, the highest since 2008. Skyrocketing home prices across the country are nullifying the effects of modest income growth and historically low interest rates, with prices climbing at a record pace for the fourth straight month

Read More

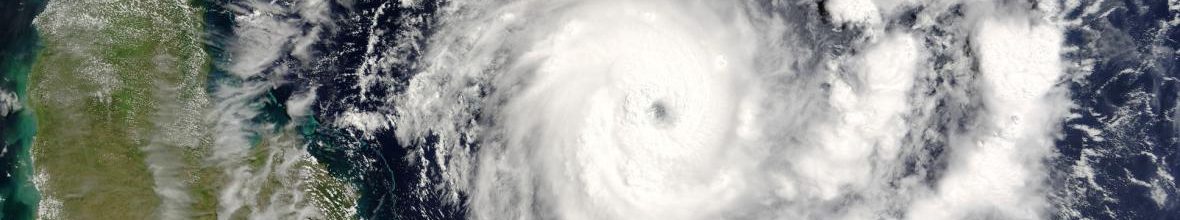

Take Steps to Maximize Insurance Benefits After a Storm

Emergency management professionals advise you to check your insurance, call your insurance company and find out what’s covered under your policy. And if your home is flooded, hire a mitigation firm to vacuum out water as soon as possible. WOODLAND PARK, N.J. – When Hurricane Ida hit, its heavy rains wreaked havoc across much of New Jersey and southern New York, causing flooding throughout the region. For homeowners faced with the task of cleaning up due to flooding, it’s often a race against the clock. How do you maximize your insurance coverage and quickly salvage your personal belongings? Here are

Read More